Average Credit Card Charges Six Potential Fees

The average credit card charges six potential fees, according to a new CreditCards.com analysis of 100 popular cards. The First Premier Bank credit card leads the way with 12 possible fees. The Pentagon Federal Credit Union Promise Visa, which charges just one, is the most fee-friendly.

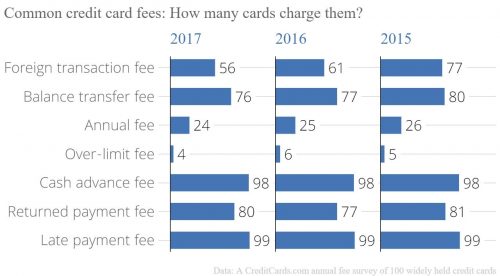

Late payment and cash advance fees are nearly universal. The most common late payment fee is up to $37 and the typical cash advance fee is $10 or 5% of the advance (whichever is greater). 85% of cards that allow balance transfers charge a fee for that privilege, most often $5 or 3% of the transfer (whichever is greater). Returned payment fees are assessed by 80 of the 100 cards and usually cost up to $37.

The average credit card charges six potential fees, according to a new CreditCards.com analysis of 100 popular cards (PRNewsfoto/CreditCards.com)

Just over half of the cards levy foreign transaction fees (generally 3% of the transaction). Approximately one-quarter come with annual fees. Only four cards impose over-limit fees.

“The good news is that all of these fees can be avoided with smart financial habits and the most common fees are among the easiest to dodge,” said Matt Schulz, CreditCards.com’s senior industry analyst. “I recommend setting up automatic payments, refraining from using credit cards at ATMs and shredding convenience checks.”

Cards with the most potential fees:

- First Premier Bank credit card (12)

- BankAmericard Secured card (11)

- Blue Sky from American Express (10)

- Hilton HHonors card from American Express (10)

- Key Bank’s Key2More Rewards (10)

- Meijer MasterCard (10)

- PNC Points Visa (10)

Cards with the fewest fees:

- Pentagon Federal Credit Union Promise Visa (1)

- Capital One Platinum (2)

- Capital One Secured MasterCard (2)

- Capital One Spark Cash Select for Business (2)

- Journey Student Rewards from Capital One (2)

- Sam’s Club MasterCard (2)

- SonyCard Visa from Capital One (2)

- Spark Classic from Capital One (2)

- Spark Miles Select by Capital One (2)

CreditCards.com surveyed 100 credit cards – a representative sampling of cards from all major U.S. card issuers – in July 2017. Fee information was gathered from the cards’ terms and conditions documents, any publicly available cardholder agreements and phone calls to issuers.

For more information:

http://www.creditcards.com/credit-card-news/2017-card-fee-survey.php