Hands Off? Not Quite. Consumers Fear Technology Failures with Autonomous Vehicles

With the exception of Gen Y,[1] all other generational groups are becoming more skeptical of self-driving technology, which poses a new challenge to car manufacturers and technology developers, according to the J.D. Power 2017 U.S. Tech Choice Study,SM released today.

“In most cases, as technology concepts get closer to becoming reality, consumer curiosity and acceptance increase,” said Kristin Kolodge, executive director of driver interaction and HMI research at J.D. Power. “With autonomous vehicles, we see a pattern where trust drives interest in the technology and right now, the level of trust is declining.”

(PRNewsfoto/J.D. Power)

Compared with 2016, 11% more Gen Z consumers and 9% more Pre-Boomers say they “definitely would not” trust automated technology. However, similar to the 2016 study, consumers this year show great interest in collision protection and driving assistance technology. Six of the top 10 features that consumers were most interested in before learning the price—smart headlights, camera rear-view mirror, emergency braking and steering system, lane change assist, camera side-view mirrors and advanced windshield display—come from these two categories.

“Along with collision mitigation, there are many benefits to autonomous vehicles, including allowing those who are unable to drive in today’s vehicles to experience freedom of mobility,” Kolodge said. “Interestingly, though, 40% of Boomers do not see any benefits to self-driving vehicles. Automated driving is a new and complex concept for many consumers; they’ll have to experience it firsthand to fully understand it. As features like adaptive cruise control, automatic braking and blind-spot warning systems become mainstream, car buyers will gain more confidence in taking their hands off the steering wheel and allowing their vehicles to step in to prevent human error.”

Additional findings of the 2017 study include:

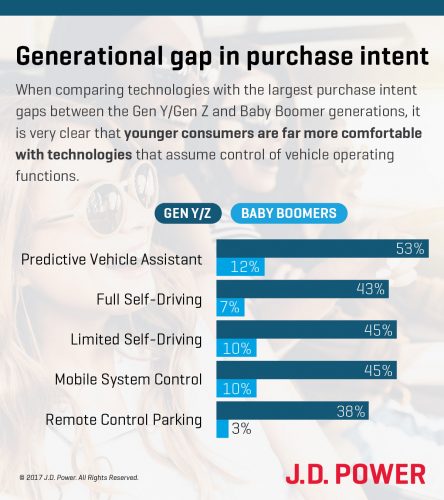

- Generation gap for vehicle-controlled functions: When looking at technologies with the largest purchase intent gaps between the Gen Y/Gen Z and Boomer generations, younger consumers are far more comfortable with technologies that assume control of vehicle operating functions. Examples include allowing mobile devices to take control of infotainment systems; an in-vehicle artificial intelligence (AI)-based assistant; and autonomous driving and parking technologies.

- Not a matter of price: For all five of the technologies with the largest purchase intent gap, Gen Y/Gen Z purchase intent is greater than Boomers, who say they definitely/probably are interested in a feature even before they know the price.

- I’m going mobile: Gen Z has the highest interest in all alternative mobility types, including 50% indicating they are definitely/probably interested in mobility sharing/co-ownership[2]; 52% for journey-based ownership[3]; 56% for unmanned mobility[4]; and 56% for mobility-on-demand[5].

- Consumer interest in emergency braking and steering system technology: Upcoming agreements between automakers and the government will require vehicles to have emergency braking—a foundation technology for autonomous driving—as a standard feature within five years. The 31% of consumers willing to pay $700 for the advanced version of this system (adds steering) is greater than the percentage of consumers who would pay for less expensive technologies like digital key at $250; dash camera at $300; and mobile system control at $400.

- Lukewarm on convenience: Consumers aren’t as enthusiastic about niche convenience technologies. Collision protection and driving assistance-related technologies comprise most of the technologies with the highest pre-price interest, while features in the entertainment and connectivity, and comfort and convenience categories show the lowest pre-price interest.

- Notable convenience exception: Gen Z consumers have a fairly high interest in digital key technology, which eliminates the need for a physical key or key fob and is replaced by a smartphone or smartwatch. A total of 40% indicate they definitely would like digital key technology on their next vehicle, and 58% are willing to pay $250 for it, compared with 28% among all consumers.

About the Study

The U.S. Tech Choice Study, now in its third year, examines consumer awareness, interest and price elasticity of various future and emerging technologies by vehicle make and consumer demographic. The major technology categories analyzed in the study are entertainment and connectivity; comfort and convenience; driving assistance; collision protection; navigation; and energy efficiency. Consumer interest in emerging concepts such as alternative mobility solutions, cybersecurity threats and trust in automated technologies also was explored.

The study was fielded in January-February 2017 and is based on an online survey of more than 8,500 consumers who purchased/leased a new vehicle in the past five years.