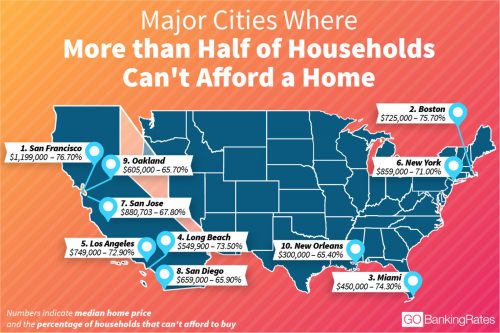

Cities Where The Majority of Americans Can’t Afford a Home

ix cities on the U.S. coasts have a 70 percent or higher percentage of households that can’t afford a home, a new study found.

Personal finance website GOBankingRates used the median home listing price in the 100 largest cities to calculate typical monthly mortgage payments. Using the rule that no more than 30 percent of income should go toward housing, GOBankingRates calculated the income needed to afford a mortgage. Researchers then compared this income to the number of households with income equal to or greater than that amount.

For full study results and more details on methodology, visit: Places Where 50% of Americans Can’t Afford a Home

Places Where 50% of American’s Can’t Afford a Home (PRNewsfoto/GOBankingRates)

Top Five Cities With the Highest Percentage of Households That Can’t Afford a Home

1. San Francisco

Median listing price: $1,199,000

Percentage of households that can’t afford a home: 76.7 percent

2. Boston

Median listing price: $725,000

Percentage of households that can’t afford a home: 75.7 percent

3. Miami

Median listing price: $450,000

Percentage of households that can’t afford a home: 74.3 percent

4. Long Beach, Calif.

Median listing price: $549,900

Percentage of households that can’t afford a home: 73.5 percent

5. Los Angeles

Median listing price: $749,000

Percentage of households that can’t afford a home: 72.9 percent

Additional Study Insights

- Perhaps unsurprising due to its high real estate prices, six of the top 10 cities with the highest percentage of households that can’t afford homes are in California.

- Some surprising cities made the final list. In New Orleans, the median home price is $300,000 but 65.4 percent of households can’t afford a home because wages are lower.

- Median home prices in Oakland, Calif., are half as expensive as they are across the bay in San Francisco.