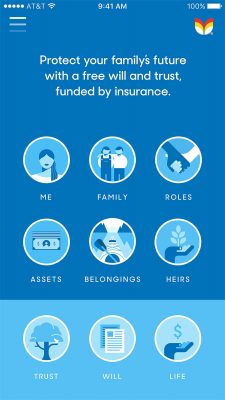

Tomorrow app, helps families make long-term financial and legal decisions

The stats are sobering: 78% of millennials do not have a will[1]; 74% of all Americans do not have individual life insurance [2]; and 50% of all millennial households would have immediate trouble paying their bills without their primary wage earner[2]. To help, Tomorrow Ideas, Inc. (https://tomorrow.me/) today unveiled the Tomorrow app, which helps families make long-term financial and legal decisions together for the first time, in an easy-to-use app designed to protect their futures.

Tomorrow overcomes the complexity, costs, and isolation that most people experience while trying to complete essential legal and financial tasks, with an app aimed at busy millennials and modern families. The Tomorrow app is the “first trust fund for everyone,” right in their pockets. It lets people create a free will and free trust (also known as a revocable living trust or trust fund) – in minutes, not months. Users can also purchase the optimal amount of affordable term life insurance within the app, or use an existing policy, and allocate future payouts to fund their own trust. The uniquely social experience also makes it easy for users to invite family and friends to serve important future roles, encouraging transparent dialog about hopes and expectations. Tomorrow guides users through these decisions, and makes them easy to change any time, with a click of their phones. It combines many of the tools used by the wealthy, and makes them accessible and affordable for everyday Americans.

“Our mission is to knock down the barriers that stop most American families from getting the kind of legal and financial protection they need and deserve,” said Dave Hanley, CEO and Co-founder of Tomorrow. “The Tomorrow app simplifies historically difficult tasks like starting a trust fund, creating a will, and buying life insurance – and makes them accessible to everyday people, not just the wealthy. Now, families can finally take this off their perpetual ‘to do’ list – in a way that is aspirational, social, and even enjoyable, right from their phones.”

Tomorrow app lets people create a free will and free trust, backed by optional and affordable term life insurance — in minutes not months (PRNewsfoto/Tomorrow)

Founder’s Story

After the difficult and unexpected loss of both parents, Dave Hanley was thrust into an antiquated world of financial and legal processes and paperwork, costly lawyers’ fees, and intense personal anguish. An accomplished CEO and digital entrepreneur, he knew there had to be a better way. He was a leading executive at Shelfari, which was acquired by Amazon, and co-founder of Banyan Branch, which was acquired by Deloitte. As such, Dave had access to resources to protect his family that many Americans lack – an inequity that troubled him deeply. Thus, an idea that was borne of hope and love for his family grew into a quest to help others, through a company called Tomorrow.

Tomorrow App

Within minutes, Tomorrow intuitively guides users through various sections of the app, including:

- Family & Roles: Users are first asked to identify family members who depend upon them, and on whom they can depend to carry out their wishes. Users can include spouses, domestic partners, children, parents, siblings, relatives, and close friends, who might receive an inheritance or special gift someday. Trusted individuals are then invited to vital roles like guardian, executor, and trustee, and sent information explaining the role’s responsibilities. The app uses the phone’s existing contacts to make it all easy, and users can change family, friends, and respective roles at any time – with a click of the phone.

- Assets & Belongings: While not a daily expense or budgeting app, Tomorrow has users list their major assets, personal belongings, and major debts, in order to organize their own will and trust.

- Snap Pictures of Personal Belongings: Listing assets is as easy as a click in the app. Users take pictures of their personal belongings, and assign which family members or friends will receive specific items after the user passes away, as part of their trust. Users can also send notifications to family and friends letting them know of their intentions.

- Life: This section of the app enables users to purchase affordable, term life insurance to help users fund their trust someday, and help their family members cover bills, pay off a mortgage, or provide for children’s future college expenses. Tomorrow helps calculate the right amount of coverage users need based on information already provided in the app. Twenty year policies start at about $13-$14 per month for a $250,000 payout*. Tomorrow is licensed to offer life insurance in all 50 states from A-rated insurance companies, including Protective Life Insurance Company, Prudential Financial, American International Group (AIG), Mutual of Omaha, and others.

- Will & Trust: Tomorrow turns important life decisions into legit legal documents, sent as a custom PDF file for users to sign, with instructions on how to make them legally binding. Beyond a will, users are asked to decide how they want to distribute financial assets placed in their very own trust – which, contrary to popular opinion, is not just for the rich. Unlike a will, trusts are not public documents. They keep belongings and financial assets private, can be used to spread out payments for children’s future expenses (i.e. college, weddings, etc.), reduce the hassle and cost of probate court for loved ones, protect assets while alive but incapacitated, and protect against variances in state laws when people move. Tomorrow’s wills and trusts are offered and legally compliant in every state except Alaska, Louisiana, and North Carolina. These sophisticated, state-specific docs are versatile enough to work for those on a tight budget to millionaires; single or married; blended or LGBTQ families; and more. Best of all, they can be changed and updated any time, at no cost, unlike conventional methods which require costly lawyer visits.

To keep personal information protected, the Tomorrow app uses bank-level security, encryption, and authentication protocols. The app is now available for download in the iTunes app store, with Android versions coming at a later date. Tomorrow also plans to add a variety of other services in the future.

Sources: 1January 2017 Caring.com Survey; 22016 LIMRA Insurance Barometer Study; *Assumes healthy, 35-year old, non-smoking female or male.